This story first appeared in the November-December 2016 issue of Soybean Business, the magazine for Minnesota’s soybean growers. Click here to read more articles from Soybean Business

On-farm storage plays crucial role in profitability

By their very nature, investments are designed to deliver favorable returns to investors. Every year farmers make investments in seed, fertilizer and other inputs in order to raise the best crop possible to enhance their profitability. At least one grain marketing expert believes farmers are missing the boat on future profitability if they aren’t investing in on-farm grain storage.

Joseph Kerns operates Kerns and Associates, a multi-faceted agricultural marketing and management firm based in Ames, Iowa. Kerns has more than 25 years of experience working with farmers and agribusinesses. He says that even in times of low grain prices, farmers should look at their situations to determine if they have enough grain storage.

“The value of on-farm storage is multi-fold, but what it really comes down to is having the ability to control my own destiny,” Kerns says.

Kerns says if a farmer makes a $2.50 per bushel investment in on-farm storage and they’re able to make 50 cents a bushel more because they’ve taken advantage of carries in the market, they’ve recouped 20 percent of their investment already. The economics only look better with a longer view.

“A 20 percent return would be a very sage investment,” Kerns says. “You’re doing something that augments the core of your grain-based business. Because storage systems can last 30 years or more, the cash return from that outlay makes it a very intelligent investment.”

Kerns says statistics show there is demand for more on-farm storage, partially because U.S. grain production keeps growing. He says the nation’s farmers have never raised 4-billion-bushel soybean crops or 15-billion-bushel corn crops before. That increased production alone demands more storage.

The U.S. has about 13 billion bushels of on-farm storage and 11.2 billion bushels of off -farm grain capacity, according to Kerns. Minnesota Grain and Feed Association Executive Director Bob Zelenka says Minnesota’s capacity skews more heavily toward the farm. Zelenka says the state has about 600 million bushels of commercial capacity and about 2.5 billion bushels of on-farm storage.

“Construction of on-farm storage had been continuing, but with the downturn in prices a lot of farmers have had second thoughts,” Zelenka says.

Kerns says a general threshold is for farmers to have enough capacity to store half of their crop. That allows farmers to take advantage of market opportunities while avoiding elevator storage costs that can cost farmers about 3 to 3.5 cents per bushel per month.

“On-farm storage opens up possibilities to enhance revenue,” agrees Robert Craven, director of the Center for Farm Financial Management and extension economist at the University of Minnesota. “In years like this, there is a carry in the market that commercial storage costs eat up.”

“Storage gives farmers a chance to manage their own grain,” Zelenka says. “Farmers are getting better all the time with their merchandising. This gives them the flexibility and efficiency to store as much as possible and not pay the 3 cents per bushel storage.”

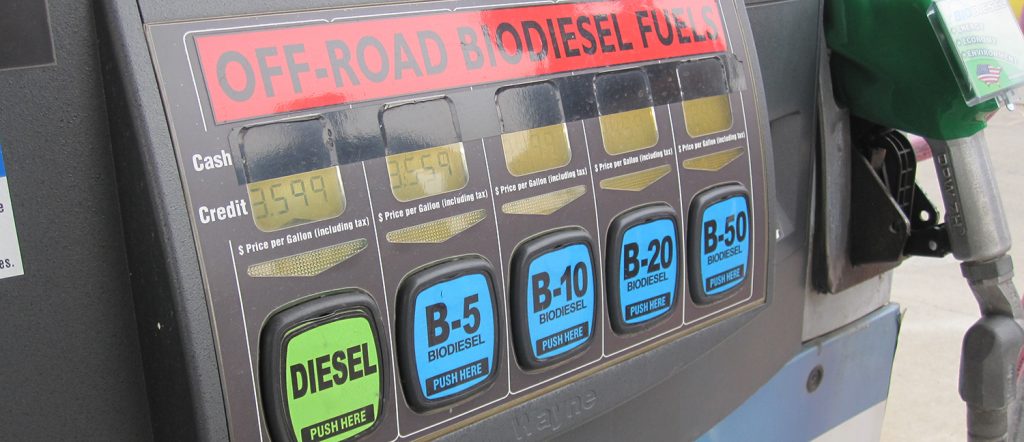

Craven says having stored crops under control can help farmers take advantage of unexpected opportunities like increased demand at a local biodiesel or ethanol plant, for example. But he also advises farmers to take a look at their balance sheet to determine if they can afford to put up additional storage.

Kerns says even in times of low commodity prices farmers shouldn’t discount the opportunities that increased storage might offer to them. While it may seem counter-intuitive, now may be a good time to invest in the future.

“There may be more acute items farmers are dealing with right now,” Kerns admits, “but grain storage is a little like regular dental work. It’s an investment in my long-term care.”