Written by Cory Bennett, MSGA lobbyist

As it seems every legislative session, the final weekend of the 2018 legislative session was a flurry of activity with last-minute negotiations and passage of bills.

Over the two-year biennium, legislators introduced a record 8,658 bills in the two-year session that ended late Sunday, May 20. Even though most went nowhere, a trio of major bills containing hundreds of policy provisions, budget appropriations and bonding projects did pass.

During the last weekend of the session, the Senate and House passed a massive omnibus supplemental spending package; then, in a second attempt within a week, passed a tax conformity bill that included special education funding requested by Gov. Mark Dayton. With minutes remaining before the constitutional deadline, the House passed a $1.4 billion capital investment bill and sent it to the governor.

However, in the days leading up to the end of the 2018 legislative session, Gov. Mark Dayton repeatedly pledged to veto major pieces of legislation that included provisions he would not accept. The governor followed through on those promises, vetoing the Omnibus Agriculture Policy Bill, Omnibus Supplemental Budget Bill and the Omnibus Tax Bill. The bonding bills fate is not yet known.

The Minnesota Soybean Growers Association (MSGA) were deeply disappointed with the vetoes of these bills that contained important legislation that would have helped struggling Minnesota farm families.

Gov. Dayton has vowed that he will not call a special session to work things out with the Republican-controlled legislature.

The 2019 Legislative Session is scheduled to convene on Jan. 8, 2019.

Items of interest that did pass.

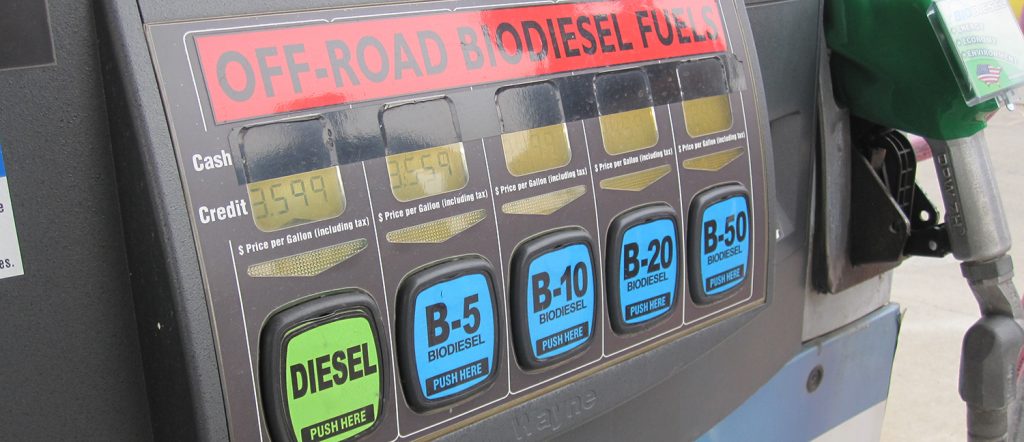

Biodiesel

The bill, SF3696 authored by Sen. Bill Weber (R-Luverne) and Rep. Paul Anderson (R-Starbuck), would modify the state’s biodiesel use mandate. The changes are as follows:

- Provides that from April 1st to April 14th each year, the minimum biodiesel content requirement is temporarily reduced to no less than 10 percent. Under current law, the B10/B20 requirement begins April 1st each year.

- Extends the biodiesel mandate exemption for Number 1 diesel indefinitely.

The biodiesel mandate law generally requires that each gallon of Number 2 diesel fuel sold in the state be 10 percent biodiesel (B10). On May 1, 2018, this requirement doubled to B20 (20 percent). The bill was a result of a compromise between the Minnesota Biodiesel Council, Magellan and the Minnesota Truckers Association.

Nitrogen Rule Delay

The House and Senate agriculture policy committees attempted to delay the adoption of the proposed nitrogen rule until the end of 2019 by passing resolution 14.126. Adopting this resolution does not require the Governor’s signature. Predictably, Gov. Dayton then vetoed the ag policy bill and voiced his strong displeasure to this legislative move in a letter to the committees. In order to find compromise , a provision that would require that the proposed MDA Nitrogen Fertilizer Rule (aka Groundwater Protection Rue) be approved by the legislature before it is implemented was removed from the Omnibus Agriculture Policy and Supplemental Budget Bills.

Ditch Mowing

Senate and House lawmakers agreed to extend a one-year halt on allowing the Department of Transportation to enforce permitting requirements related to ditch mowing along state highways.

Sponsored by Rep. Chris Swedzinski (R-Ghent) and Sen. Gary Dahms (R-Redwood Falls), HF4008/ SF3569, this would extend a permit moratorium until April 30, 2019. Signed into law last year, it was intended to give state transportation officials, agricultural interests and environmental advocates more time to study the issue.

The moratorium came about following backlash to a MnDOT plan in 2016 to apply a standardized ditch mowing permit for all eight transportation districts across the state. That angered those who, for years, had been mowing or haying land in MnDOT right-of-way along highways without a permit.

Hours of Service

The bill, HF3528/SF3405 authored by Rep. Tim Miller (R-Prinsburg) and Sen. Andrew Lang (R-Olivia), modifies exemptions from motor carrier hours of service requirements for agricultural transportation. “Hours of service” refers to carrier requirements in federal regulations (incorporated into state statutes with exceptions) on amounts of driving time, periods of rest, and logging of on-duty and rest times. It does this by Broadening the harvest season to be year-round for an hours of service exemption in intrastate transportation of agricultural commodities and farm supplies within a 150-air mile radius. It also clarifies that the exemption covers all hours of service regulations, including electronic logging device rules.

Ag Research Data

Sponsored by Rep. Rod Hamilton (R-Mountain Lake) and Sen Bill Weber (R-Luverne), HF2982, as amended, would strengthen data privacy rules for farmers who contribute information to the university’s research projects. The concern is that individuals will not participate in research studies if their identity is made public. The bill is to further the research that the University of Minnesota is trying to accomplish.

Under the bill, data the university creates, collects or maintains on an agricultural analysis platform would be classified as private or nonpublic data, although that information could be disclosed with written permission from the individual or in response to a threat.

Items of interest that did not pass.

Omnibus Agriculture Policy Bill

The House and Senate Omnibus Agriculture Policy Bill, HF4133 sponsored by Rep. Paul Anderson (R-Starbuck) and Sen. Bill Weber (R-Luverne), would have made a number of policy and technical changes to statutes including:

- Reverts authority for soil loss ordinances back to the county level not BWSR. The provision was added at the 11th hour of the buffer legislation passed in 2015

- Adjusted the minimum eligibility threshold for the Bioincentive Program

- Updated regulations to help establish and grow value-added aquaculture production

- Expanding eligibility to drainage authorities for low-cost financing to implement drainage system improvements through the Agriculture Best Management Practice loan program

- Improved access to the Beginning Farmer Tax Credit program by clarifying eligibility requirements

Omnibus Supplemental Budget Bill

The bill proposed to appropriate about $76 million this year, on a variety of area from agriculture and the environment to higher and K-12 education, public safety, health and human services, and broadband, plus another $58 million on transportation, primarily roads and bridges. HF4099/ SF3656 authored by Rep. Jim Knoblach (R-St. Cloud) and Sen. Julie Rosen (R-Vernon Center). Gov. Dayton vetoed the flowing:

Agriculture and Rural Development Provisions

- $250,000 for mental health and counseling services for rural Minnesota. Securing more available mental health services for farmers was a top MSGA priority throughout the 2018 session;

- $15 million in rural broadband development grants.

Environment Provisions

- prohibiting the PCA from increasing water permit fees until approved by the legislature (House);

- allowing a landowner who is required by law to establish buffer strips a waiver until July 1, 2019 for public ditches and those classified as public waters;

- clarifies that counties have the authority to adopt or not soil loss ordinances rather than allowing BWSR the authority to require model ordinances for those counties who chose to not adopt such regulations.

Transportation Provisions

- $12.8 million for continued development of the state’s troubled vehicle license and registration system, MNLARS, far less than the $33 million in additional funding the Dayton administration has requested;

- $10.7 million in township road aid;

- $10 million on the Corridors of Commerce program;

- $8.5 million in supplemental funding for the Small Cities Assistance Fund to aid local road projects;

- $5 million in additional funds to reimburse deputy registrars impacted by the state’s botched rollout of MNLARS;

- $4 million in Township Road Aid.

Omnibus Tax Bill

Federal tax conformity was a top-tier priority of MSGA for the 2018 legislative session. The passage of the Tax Cuts and Jobs Act (TCJA) by Congress created an opportunity for Minnesota to conform to those changes. The tax conference committee passed two compromise pieces of conformity legislation (largely similar), and ultimately both were vetoed by the Governor, the last bill being vetoed on Wednesday the 23rd.

The following provisions would have been very beneficial to Minnesota’s ag and food sectors:

- Sec. 179 expensing – Minnesota is one of the few states that does not conform to federal equipment expensing provisions. This portion of federal law allows farmers and businesses alike to deduct from their taxable income purchases of equipment, software, and many other items for the use of their operations in that taxable year. The previous federal allowance was $500K dollars. Under the new tax law, that allowance is $1M dollars. Under Minnesota current law, that limit is $25K dollars.

- Ag homestead status clarification – This year, agriculture groups brought a property tax provision to the legislature that would have ensured that Minnesota farm families could enjoy the same property tax treatment on their ag homesteads. The Department of Revenue had issued an opinion which would have taken away beneficial property tax rates for members of family that had property placed in trusts or other agreements such as LLC’s.

- Buffer tax credit – The new buffer law, which was signed into law in 2015, effectively removed tillable acres without compensation for many Minnesota farmers. MSGA signed onto a coalition to create a new tax credit equal to $50 dollars for each tillable acre removed from production. The coalition agreed that the credit should be paid for by the Clean Water Fund.

Transportation Constitutional Amendment

In the closing days of session, the House passed HF4437, a bill to place a constitutional amendment on the November ballot which, if approved by the voters, would fully dedicate sales tax revenue from car repair and replacement parts to fund road and bridge projects.

After passage, Senate Majority Leader Paul Gazelka said his caucus did not have the votes to pass the measure, which does not need the Governor’s signature. This means that this effort to place this measure on the ballot is dead for this biennium.

Items still awaiting Gov. Dayton’s signature.

Bonding

HF4425, sponsored by Rep. Tim Miller (R-Prinsburg) and Sen. Rich Draheim (R-Madison Lake), the infrastructure-heavy plan contains $1.43 billion in total appropriations; $825 million of which would be general obligation bonding. Projects of interest include:

- $80 million for higher education asset preservation evenly split between the University of Minnesota and the Minnesota State system;

- $35 million for the Rural Finance Authority to, in part, help beginning farmers and restructure other farm loans;

- $200 million transportation infrastructure;

- $25.35 million for water and wastewater needs in a dozen cities;

- $20 million for flood hazard mitigation;

- $18 million to construct a statewide Second Harvest Heartland charitable food facility;

- $28.1 million for mental health crisis centers.