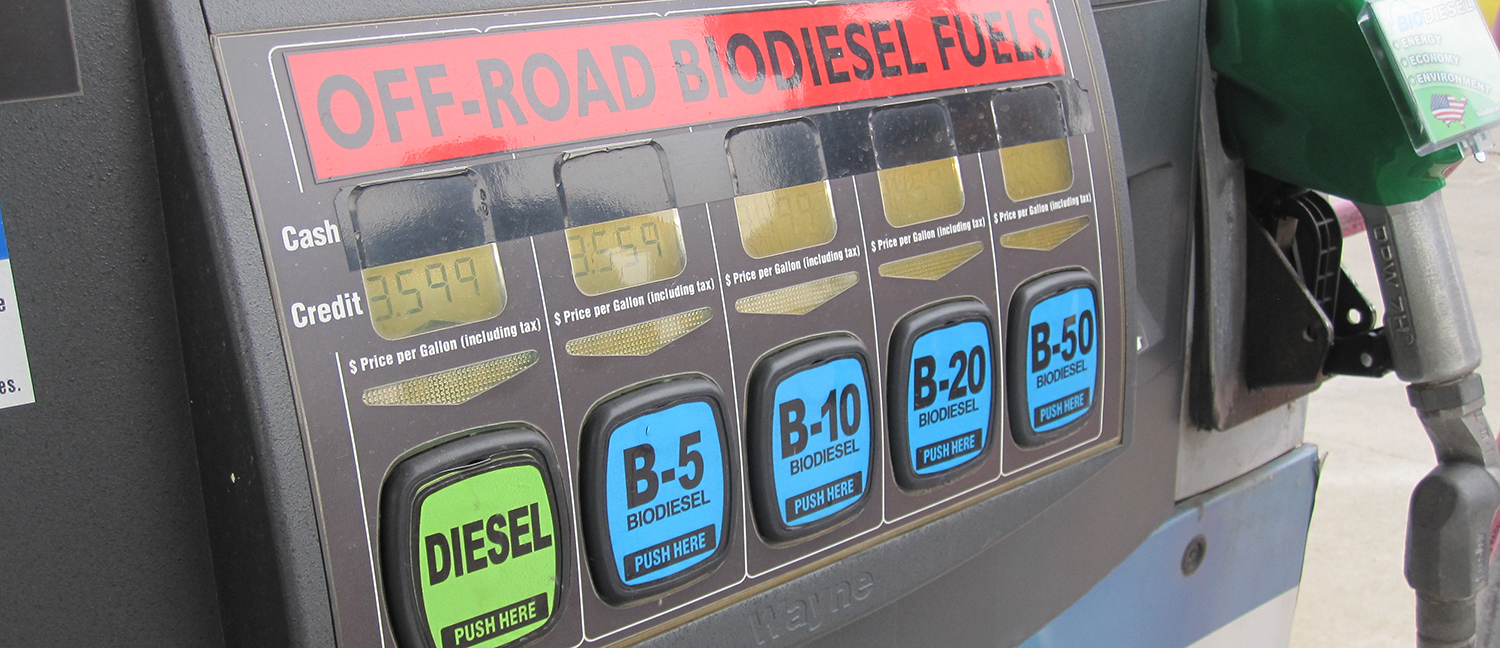

In honor of Earth Week 2024, U.S. Department of Agriculture (USDA) Rural Development State Director Colleen Landkamer announced that USDA is funding more than 80 clean energy projects in Minnesota to lower energy bills, expand access to domestic biofuels and…

April 26, 2024

For Minnesota farmers and livestock producers experiencing times of stress due to business and financial challenges, the Minnesota Department of Agriculture (MDA) offers a reminder of free, confidential tools that are available to help. “From low commodity prices and extreme…

April 25, 2024

The American Soybean Association (ASA) joined the nation’s major commodity groups, in sending a letter to the U.S. International Trade Commission to encourage it to vote negative in advancing a petition by Corteva Agribusiness to place antidumping and countervailing duties…

April 22, 2024

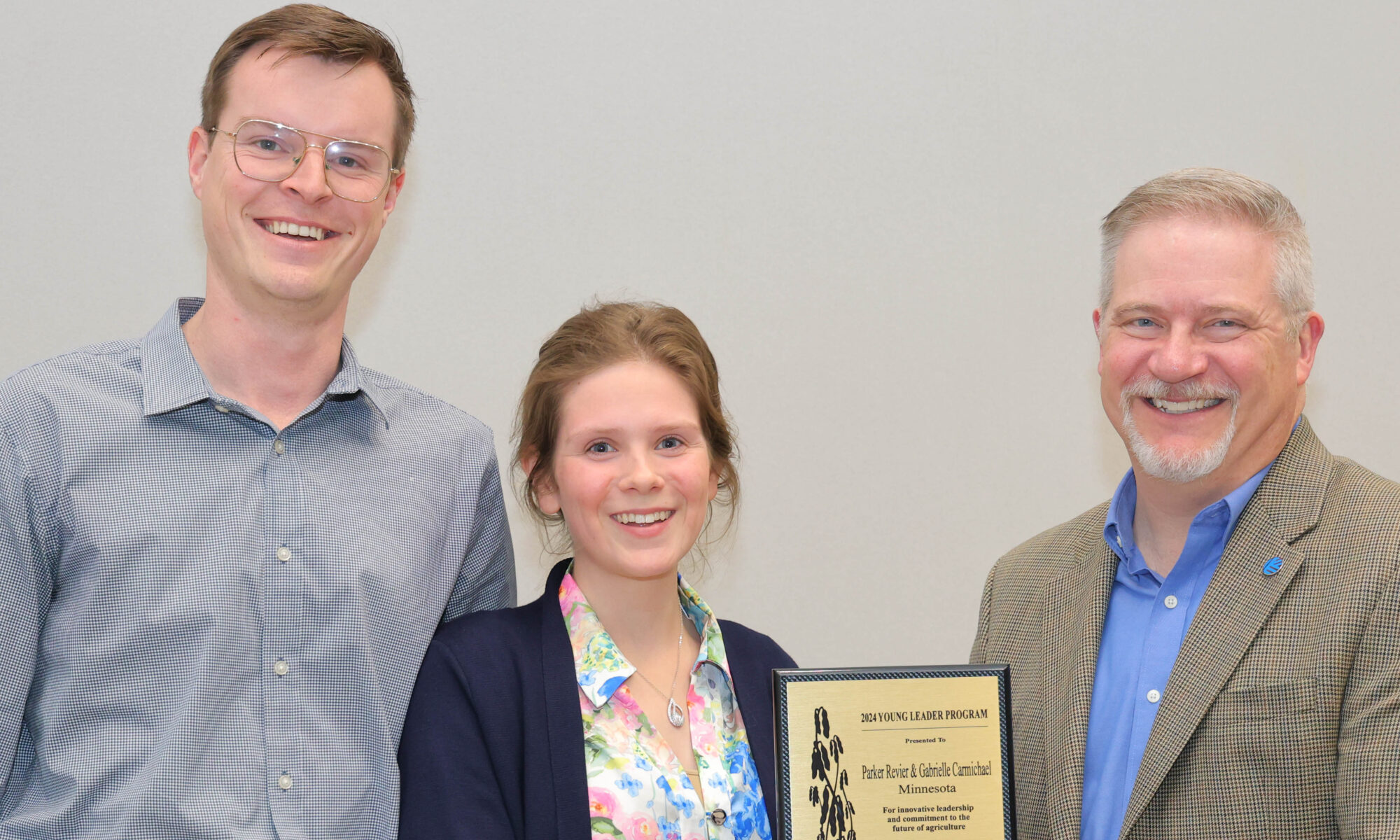

Leadership is a continuous journey that can’t be measured from a year-long program. It is measured in what you gain. Parker Revier recently completed the American Soybean Association (ASA) Corteva Agriscience Young Leader Program with his significant other, Gabrielle Carmichael.…

April 22, 2024

Membership in the Minnesota Soybean Growers Association (MSGA) means supporting an advocacy team with direct connections to legislative leaders. Case in point: On April 16, MSGA Executive Director Joe Smentek met with Rep. Rick Hansen, DFL-South St. Paul, who chairs…

April 17, 2024

The Minnesota Soybean Growers Association (MSGA) continues to keep a close eye on the latest legislative developments in St. Paul as the 2024 legislative session enters its final weeks. By being proactive and supporting a lobbying team that stays abreast…

April 11, 2024

Demand is high for the Minnesota Department of Agriculture’s (MDA) new Soil Health Financial Assistance Grant. MDA recently awarded 81 grants to individual producers, producer groups, and local governments to purchase or retrofit soil health equipment. The grants, which are…

April 4, 2024

Bob Worth, the president of the Minnesota Soybean Growers Association (MSGA), isn’t one who gets nervous often during meetings with legislators and regulators. Twenty years of farmer advocacy at the state and national levels has had a calming effect. But…

April 4, 2024

No one said supporting the Minnesota Soybean Growers Association (MSGA) must be all work and no play. Sometimes, supporting MSGA’s advocacy efforts is as simple as teeing up a golf ball and smashing it down the fairway. OK, well that…

March 27, 2024