In 2022, the average age of the U.S. farmer was 58 years old, according to the 2022 Census of Agriculture. As the average age for farmers continues to increase, the Minnesota Soybean Research & Promotion Council (MSR&PC) is making checkoff…

April 25, 2024

Minnesota weather is unpredictable and often the topic of small talk. This year, the wind may be whipping, and the rain has come down in some areas, but that hasn’t slowed operations down for planting preparation and overall planting. “Ground…

April 25, 2024

Minnesota Soybean continues to distinguish itself on the national stage. At this year’s National Agri-Marketing Awards (NAMA) awards in Kansas City, the Minnesota Soybean Research & Promotion Council (MSR&PC), which directs the state’s checkoff program, and Minnesota Soybean Growers Association…

April 25, 2024

With his decorated history in agriculture, a Minnesota farmer leader prepares to put on a new hat as a newly elected member of the Northern Crops Council (NCC). Paul Freeman was appointed to replace Kris Folland on NCC. Folland, who…

April 25, 2024

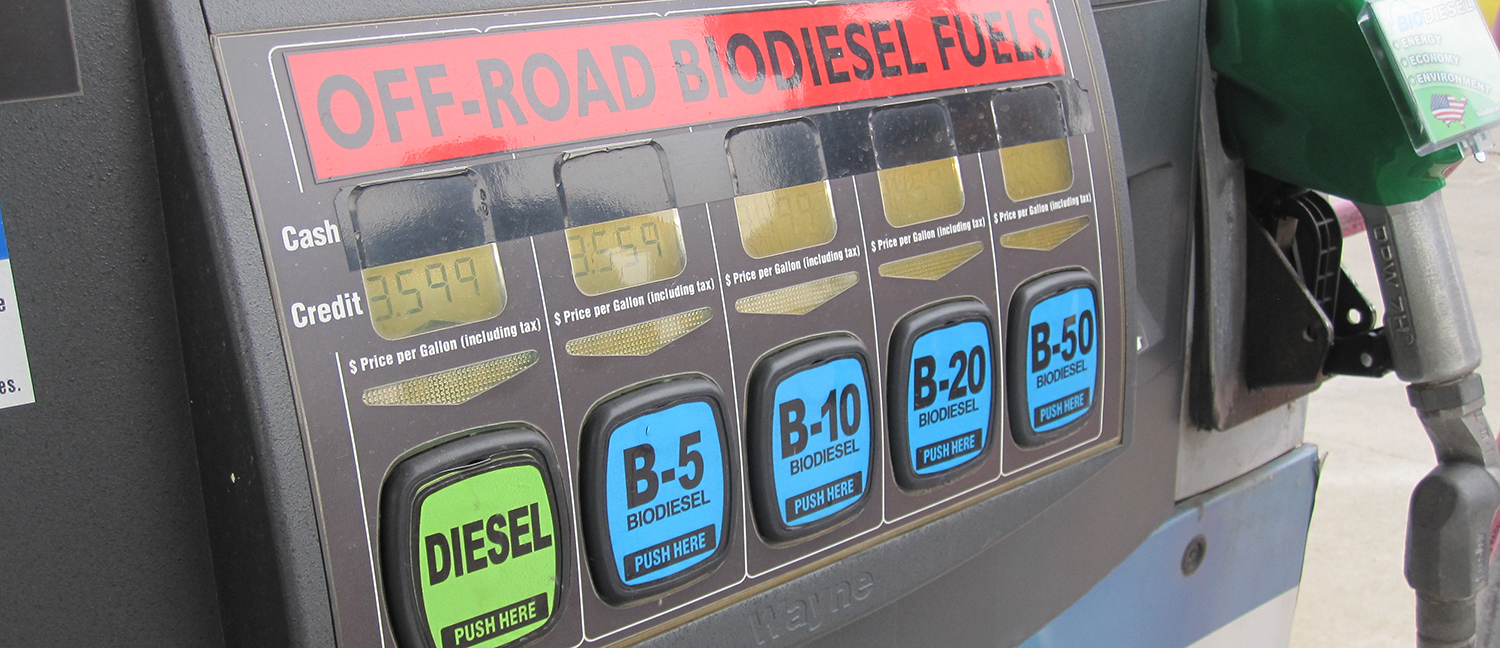

When biodiesel first entered Minnesota’s marketplace in 2005 after the state enacted a 2% (B2) biodiesel law and then moved to B5 in 2009, the end users had a lot of questions about the product. Is it safe? Is it…

April 18, 2024

Nothing gives a Minnesota soybean grower heartburn like driving by their soybean field and seeing it peppered with weeds. And when the big bad wolf of weeds – waterhemp – rears its ugly head, blood pressures are bound to rise.…

April 18, 2024

Now in its seventh year since the B20 requirements were enacted, the state of Minnesota is beginning its transition toward a 20-percent biodiesel blend (B20) during the summer months. Between the months of October through March, the state of Minnesota…

April 11, 2024

From the hospital to the office, leaders in the biobased industry are planting seeds for new, innovative uses for soy. Sponsored by the Minnesota Soybean Research & Promotion Council and the soy checkoff, the Agricultural Utilization Research Institute’s (AURI) 2024…

April 9, 2024

Minnesota’s unique county soybean program helped feed families during the Easter holiday. The Norman County Soybean & Corn Growers and their checkoff dollars are continuing their support of the Rural Enrichment and Counseling Headquarters (REACH) by donating hams to help…

April 2, 2024